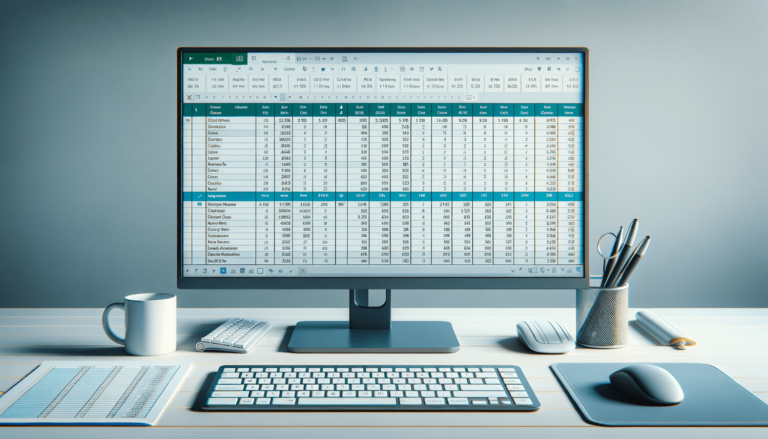

Welcome to our blog on how to create a pay stub in Microsoft Excel. For many small business owners, creating a pay stub is an essential task that needs to be performed each pay period. Using Excel to create a pay stub can be an easy and effective way to produce professional-looking documents that show employees how much they’ve earned and any deductions that have been taken from their paychecks. In this post, we will walk you through the steps to create a pay stub using Excel.

The first step in creating a pay stub in Excel is to open a new document. You can do this by clicking on the “File” tab in the upper-left corner of the Excel window and selecting “New.” This will open a list of available templates. If you do not see a pay stub template, you can search for one by typing “pay stub” into the search bar.

The next step is to enter basic information about your business and the employee who will be receiving the pay stub. This includes the company name and address, employee name, pay period, and pay date. Make sure to double-check the information for accuracy before moving on to the next step.

After entering the basic information, it’s time to input the earnings for the pay period. This includes the employee’s hourly or salary rate, as well as the total number of hours worked. Excel can automatically calculate the gross pay by multiplying the hourly rate by the number of hours worked. Alternatively, if the employee is salaried, you can enter their total salary per pay period directly into the pay stub.

Next, it’s time to enter any deductions that will be taken from the employee’s paycheck. This can include federal and state taxes, Social Security and Medicare taxes, as well as any insurance premiums or retirement contributions. Make sure to accurately calculate the deduction amounts based on the employee’s earnings and the applicable tax rates.

Finally, you may want to include additional information on the pay stub, such as the employee’s year-to-date earnings and deductions, as well as any bonuses or other compensation. You can also add a line for the employee’s net pay, which is the amount they will actually receive on their paycheck.

Creating a pay stub in Excel can be a straightforward process that helps keep your business running smoothly. By following these steps, you can produce professional-looking documents that accurately reflect your employees’ earnings and deductions. With a little practice, you’ll be able to create pay stubs in just a few minutes!

If you cannot find a pay stub template on Excel that meets your needs, you can easily create one tailored to your business. Start by selecting an Excel spreadsheet that you like and then customize the header with your business logo and other relevant information. You may also want to include additional fields for overtime pay, bonuses, and other types of compensation.

To add these fields, click on the “Insert” tab and select “Text” or “Number” from the “Form Controls” section. From there, you can enter the name of the field and then adjust the cell formatting to make it match the rest of the pay stub.

Once you have created your pay stub template, you can save it for future use. To do this, simply click on the “File” tab and select “Save As.” Save the file as an Excel template by selecting “Excel Template (*.xltx)” from the “Save as type” dropdown menu. You can then use this template each pay period by opening it and changing the information as needed.

If you have a larger business or find Excel to be too overwhelming, payroll management software can help streamline the process. Payroll software can automatically calculate payroll taxes and deductions, generate pay stubs, and even file payroll taxes on your behalf. However, these systems can be costly, so make sure to do your research before committing to a payroll solution.

Creating pay stubs in Excel is a simple and effective way to manage your payroll process. By following these steps, you can quickly create professional-looking pay stubs that accurately reflect your employees’ pay and deductions. Whether you decide to customize your pay stub template or use payroll management software, managing your payroll can help keep your business running smoothly.

Here are some of the most frequently asked questions about creating a pay stub in Excel:

At a minimum, a pay stub should include the employee’s name, the pay period, the amount of gross pay, and any deductions taken from the paycheck. Some pay stubs also include the employee’s year-to-date earnings and deductions.

Double-check all the information that you enter, particularly when it comes to the employee’s hourly rate or salary and the correct tax rates. You can also use Excel functions to make calculations for you and ensure accuracy.

Yes. You can customize an Excel pay stub template with your logo, business name, and other branding elements. This ensures that your pay stubs are consistent in style and also serves as an opportunity to reinforce your brand.

Payroll software can automate many of the payroll processes, saving time and reducing the risk of errors. It can also help generate tax returns and other reports, and track paid time off and vacation time. However, payroll software can be expensive and may not be necessary for smaller businesses with a relatively straightforward payroll process.

Most states require that employees receive a pay stub with each paycheck. Check your local regulations to ensure that you are in compliance. However, it’s a good business practice to provide employees with a pay stub with each paycheck to ensure transparency and accuracy in the payroll process.

Explore the world of Microsoft PowerPoint with LearnPowerpoint.io, where we provide tailored tutorials and valuable tips to transform your presentation skills and clarify PowerPoint for enthusiasts and professionals alike.

Your ultimate guide to mastering Microsoft Word! Dive into our extensive collection of tutorials and tips designed to make Word simple and effective for users of all skill levels.

Boost your brand's online presence with Resultris Content Marketing Subscriptions. Enjoy high-quality, on-demand content marketing services to grow your business.